What Is A Good Credit Score?

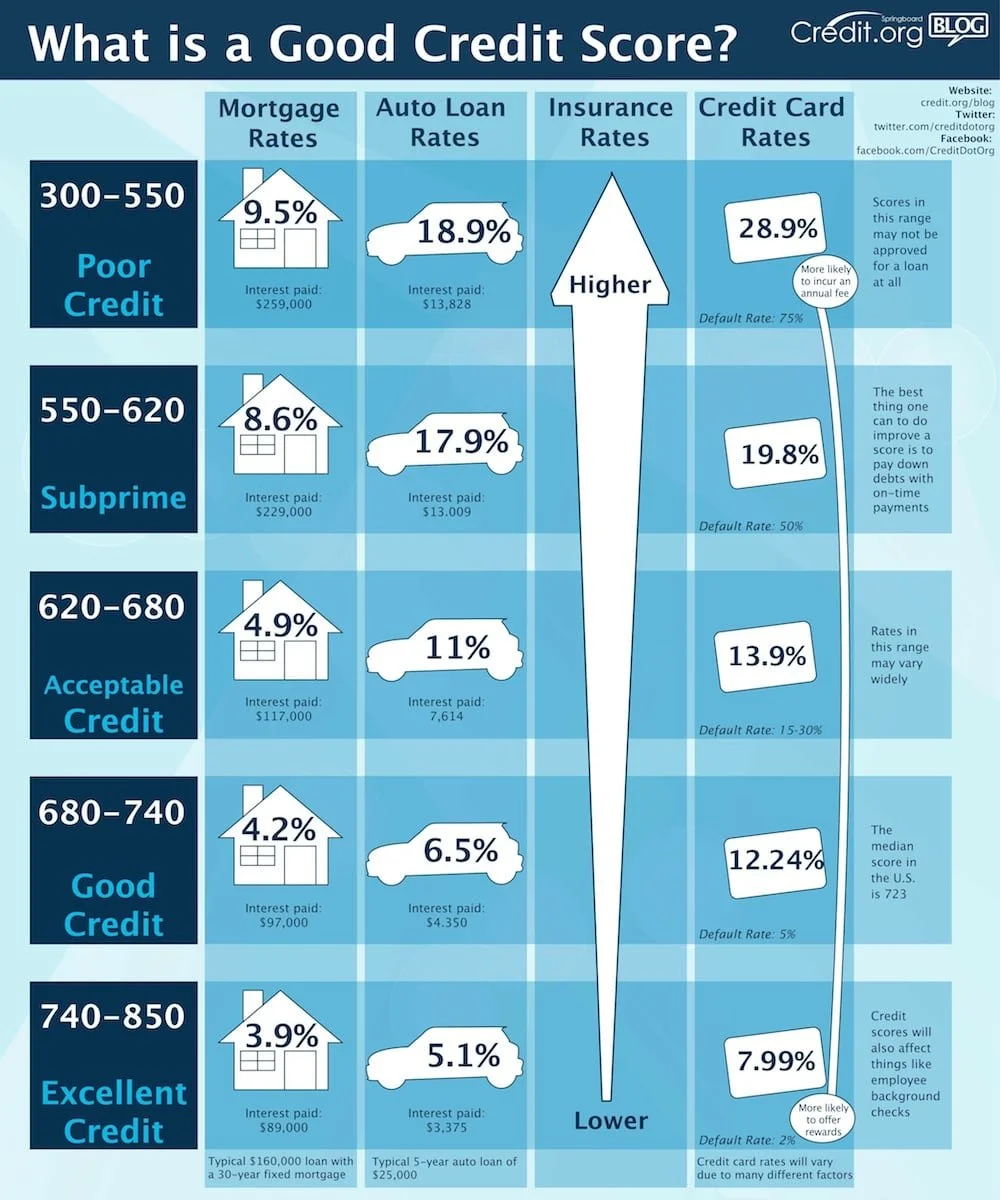

Have you ever wondered what a good credit score is? The credit score scale ranges from 300 to 850 and a good credit score is anything above 720. To help you visualize the credit score range here is an infographic from Credit.org.

300-550: Poor credit. Credit scores below 550 are going to result in a rejection of credit most every time. If your score has fallen into this range, you need to work to improve your score.

550-620: Subprime. It’s possible to get credit in this range, but there are no guarantees. If you do get a loan, you will not get very good terms. You will pay much higher interest rates and penalty fees. In this range it is worthwhile to address any specific credit problems you have and try to boost your score before applying for credit.

620-680: Acceptable. Scores in the mid 600’s mean you will probably get credit when you apply for it. You still won’t get the best interest rates, but borrowers with scores over 620 are considered less risky and are therefore likely to be approved.

680-740: Good credit. Scores near 700 are considered “good” credit. Borrowers in this range will almost always be approved for a loan, and be offered very good interest rates. At this credit score, lenders are comfortable with the borrower, and the decision to extend credit is much easier.

740-850: Excellent credit. From the mid 700’s and higher is considered excellent credit, and credit approvals will be quick and easy and at the very best interest rates.

Of course, different lenders have different standards, and your experience may vary. You may have a high credit score, but a negative public record on your credit file may hurt your chances of getting a loan. And remember, while credit scores don’t take your income into account, lenders will, and if they feel you simply can’t afford the loan you’re applying for, they won’t approve you no matter how good your score.

So you can see that getting to a score in the mid 600’s might enable you to qualify for credit, but a score of 680 or above is the threshold for “good” credit. And if you can get your score up to the mid 700’s, your credit will be considered excellent, and you will have few worries when it comes to qualifying for credit at favorable rates.

Source: Credit.org